TESTATOR FAMILY MAINTENANCE

NetActuary specialises in actuarial calculations for the legal profession Australia-wide, including in the area of

Testator Family Maintenance / Family Provision Claim matters. Many common law countries (such as the UK and South Africa) currently use actuaries

in the area of estate litigation far more extensively than Australia. Calculating a family provision lump sum claim relies on the ability to predict

future variables - an area in which actuaries have expert knowledge. An actuarial calculation can increase the likelihood of achieving a suitable

outcome for your client.

Actuarial advice enhances the accuracy of answering the second question in Singer v Berghouse (1994) HCA 40, that is,

what provision ought to be made for a claimant’s proper maintenance, education or advancement in life. Just as the Courts look to the individual

circumstances of each case (Vigolo v Bostin [2005] 221 CLR 191, 231), likewise our actuarial assessments take into account the claimant’s

individual circumstances. We can take into account mortality improvement trends, expected future living expenses including any prospect of

employment, cost of living increases, anticipated Age Pension entitlements etc.

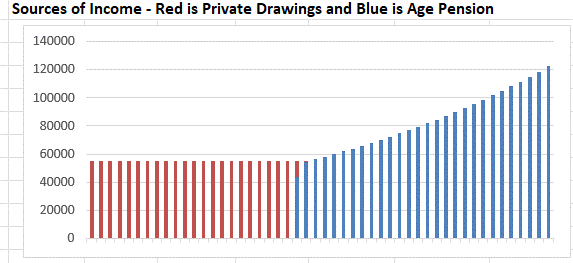

Consider a hypothetical example where Susie is making a testator family maintenance claim against her mother’s Will.

Susie is 45 years old, physically disabled and lived with her mother up until her mother’s death. Her mother provided her with an income of

$55,000 a year. We contrast simply making a claim for $55,000 pa until Age Pension age and the more realistic computational model of

$55,000 pa in real terms (i.e. with allowance for cost of living adjustments).

If cost of living increasesa are not allowed for, the claim is $615,141 compared to $921,751 when allowing for these increases. The claim would be $306,610 short in providing Susie with the standard of living she has become accustomed to.

We are aware that every state has slightly different requirements regarding which factors should be considered when

deciding on adequate provision. However, all jurisdictions have in common the consideration of the claimant’s “financial need” as a central issue

(Blore v Lang [1960] HCA 73; Joss v Joss [2020] VSC 424; Cowap v Cowap [2020] NSWCA 19; Bella v Roberto Bei as Executor of the Estate of the Late

Giovanni Bei [2020] WASC 348). “Financial need” depends on more than a claimant’s current income and debts projected forward - it also takes into account

other variables such as potential receipt of the aged pension in the future.

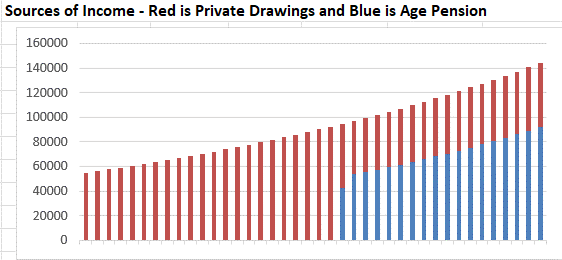

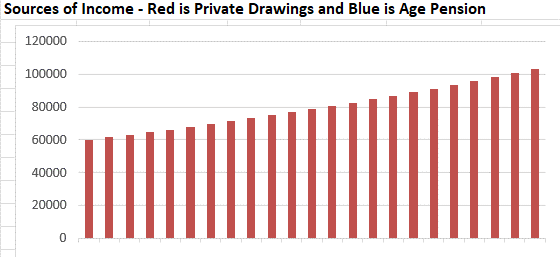

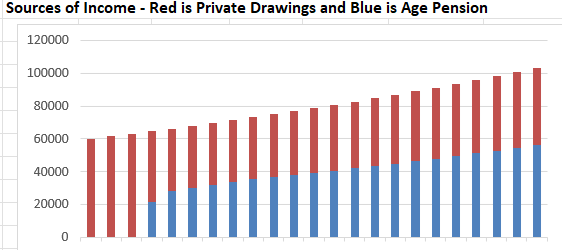

Consider a second example where the claim on the Estate is excessive because the potential Age Pension has not been taken into

account. David acts as executor for his deceased father John’s estate. David’s step-mother Carol (John’s second wife) is claiming inadequate

provision. Carol is currently 64 years old. To calculate an accurate sum, an examination of Carol’s future needs requires an assessment of Carol’s

potential future receipt of the aged pension upon reaching aged pension age. A diligent examination of the aged pension on a yearly basis can result

in a sum which places a significant lesser burden upon the estate while still ensuring Carol has adequate provision for her proper maintenance

and support. The example assumes Carol requires a yearly income of $60,000 with 2.5% p.a. CPI increases.

.

With a realistic projection taking the Age Pension entitlement into account, the Estate only need to pay out $501,019 instead

of $879,604 - a $378,585 saving.

Actuarial calculations enhance the precision of calculations. Our reports are $374 (inclusive of gst) To discuss further please do not hesitate to

contact Claire (claire@netactuary.com.au) or Brian (brian@netactuary.com.au) or by phone on (03) 9028 5002.